You can explore the topics that interest you most by clicking on the categories below.

Welcome to our Group Retirement Services 2023 Year in Review!

After so many important launches and publications in 2023, we are excited to launch our annual Year-in-Review!

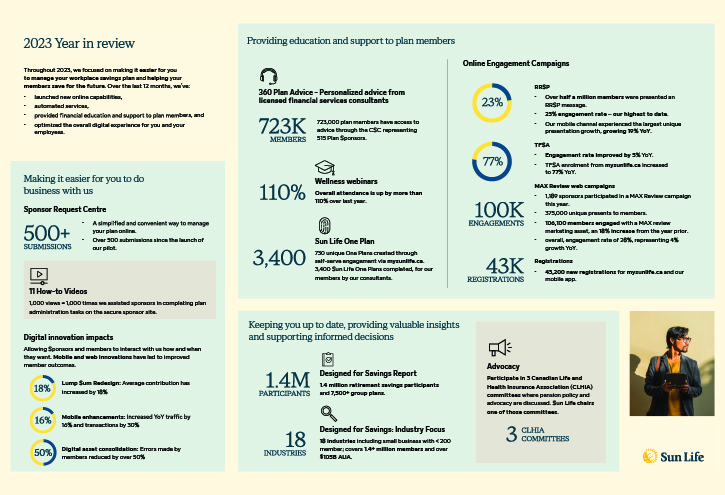

Throughout 2023, we focused on making it easier for you to manage your workplace savings plan and helping your members save for the future. Over the last 12 months, we’ve:

- launched new online capabilities,

- automated services,

- provided financial education and support to plan members, and

- optimized the overall digital experience for you and your employees.