Plan sponsors may wish to consider whether this investment news has any implications for the investment options available within their plans. Sun Life Assurance Company of Canada purchases units of the funds listed below, which are established as segregated funds in accordance with the Insurance Companies Act (Canada).

We are writing to provide plan sponsors with an update and our most recent perspectives on the Sun Life Milestone Target Date Series of Segregated Funds (Milestone Funds), currently available in your capital accumulation plan(s). Importantly, we hope that this update encourages plan sponsors to review whether the Milestone Funds are still an appropriate option for their plan members, particularly in cases where these funds are the default option.

Background

Sun Life launched the Milestone Funds in 2010, when only a few Target Date options existed in Canada. Since then, many more Target Date options have become available. In addition, market environments have changed over time. When the Milestone Funds were launched, interest rates were higher, so their expected long-term returns were greater. The low interest rate environment over the past decade has adversely affected the Milestone Funds’ long-term return outlook. While interest rates have increased over the past two years, this won’t be of immediate benefit to the Milestone Funds and has been detrimental to performance in the short term.

The Milestone Funds offer the unique Guaranteed Maturity Value (GMV) feature. Therefore, they have a lower allocation to equities and a higher allocation to bonds compared to traditional Target Date Funds (TDFs). The lower equity and higher bonds allocations in the Milestone Funds limit their long-term growth relative to more traditional TDFs. Notably, the Milestone Funds’ bond component is primarily in government bonds (no corporate bonds and limited/no provincial bonds). The lower expected growth in the Milestone Funds may affect members’ ability to save enough money for retirement, particularly for younger members who are still far from retirement.

For these reasons, in 2022, Sun Life Group Retirement Services (GRS) stopped offering the Milestone Funds to plan sponsors who did not already offer the funds in their line-ups.

Do you have to take any action?

We encourage you to review whether the Milestone Funds remain an appropriate Target Date option in your plan. We have provided more information about the Milestone Funds below and a Frequently Asked Questions document here for reference. If you have any questions, please contact your GRS representative.

Sun Life will continue to conduct governance on the Milestone Funds for the foreseeable future and continue to assess viability of these Funds periodically. If the assets in the Milestone Funds become too low, Sun Life may choose to close these Funds and transfer assets to alternative options. The Milestone Funds have experienced significant Client redemptions over the last few years. As of March 31, 2024, the Milestone Funds’ assets represented only 2.07% of total TDF assets on Sun Life’s Core platform (and 0.89% of the overall platform).

We’ll provide the following support for you and your members for the review and potential transition from Milestone Funds to replacement TDFs:

- Investment Solutions Executive (ISE) support to review the suitability of Milestone Funds in your plan(s) and/or recommendations for replacements, if required.

- A sample of the member communication that includes rationale for the change, features and benefits of the replacement TDF is available here.

- Members also have access to Sun Life’s 360 Plan Advice, where they have access to one-to-one support through licensed financial services consultants that are dedicated to workplace savings plans, at no additional cost.

Long-term return outlook for the Milestone Funds

The Milestone Funds have a different structure than traditional TDFs, due to the GMV feature. The Milestone Funds are designed to hold bonds that mature at the maturity date equal to the value of the guarantee. Consequently, relative to traditional TDFs, the Milestone funds have a lower equity allocation and a higher allocation to bonds, to support the GMV feature. This is illustrated below.

Target Date Fund Glidepath (Equity/Age)

The Milestone Funds’ low equity allocation may limit their long-term returns over time, relative to traditional TDFs. The high allocation in fixed income also affects the return outlook for the Milestone Funds for the following reasons:

- Lower expected returns for the bond portion of Milestone Funds, relative to equities. While this is also true for other Target Date Funds, the impact is larger for Milestone Funds. This is due to a significantly higher bond allocation.

- Interest rates were low or falling for many years, until the end of 2021. As rates declined, the manager of Milestone Funds, SLGI Asset Management Inc. (SLGI), needed to purchase higher amounts of bonds over time. This was to ensure enough bonds are held by the funds to maintain the guarantee. As a result, Milestone Funds’ bond allocations increased and equity allocations decreased, over time.

- The recent interest rate increases also have had a negative impact on the Milestone Funds, particularly those with longer maturity. When interest rates increase, the price of fixed income securities falls. The longer-dated Milestone Funds are more sensitive to interest rate changes since the price decrease is larger for securities with longer maturities.

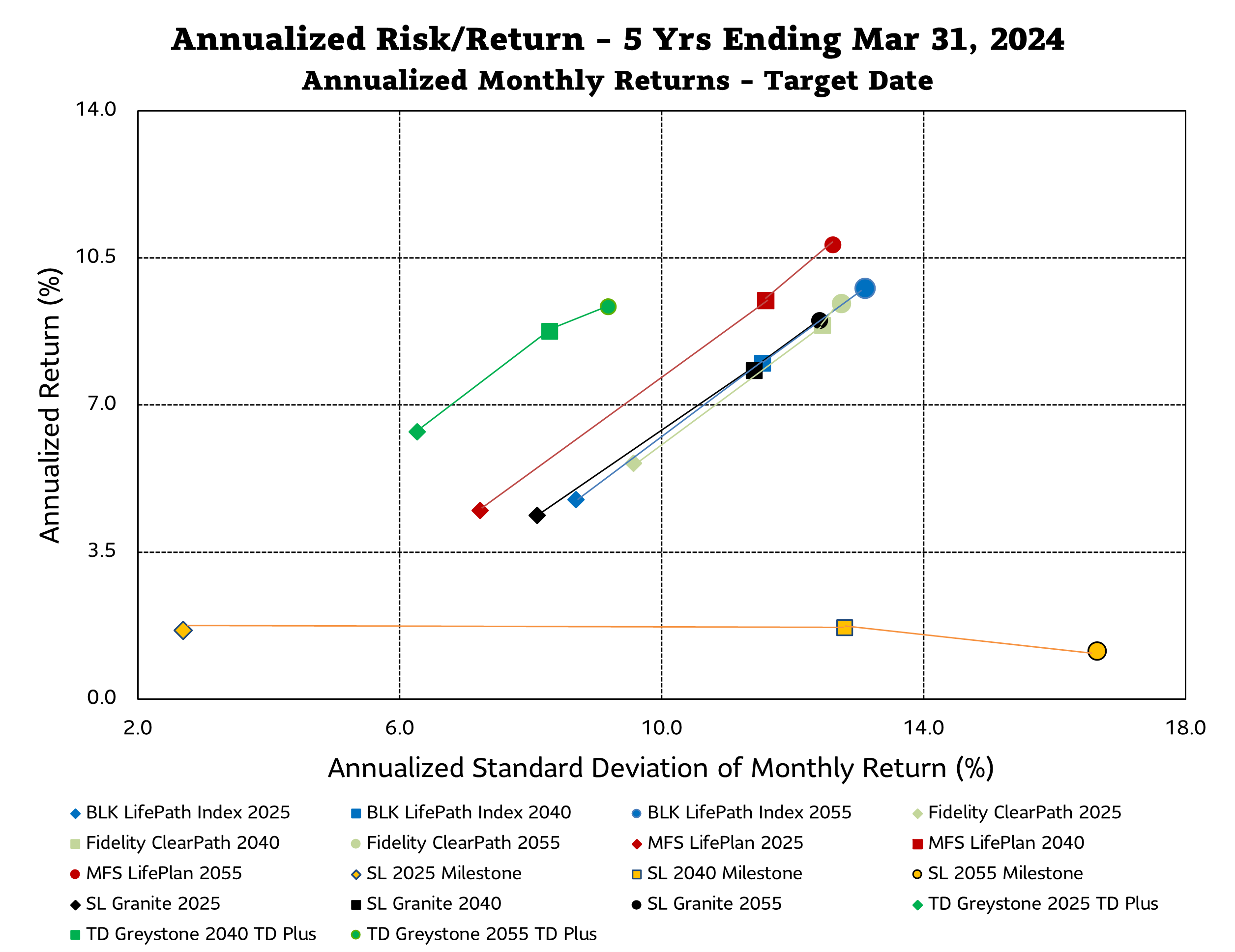

The Milestone Funds’ structure has led to significant differences in return and risk compared to the traditional TDFs, as shown in chart below.

A note about the Guarantee Maturity Value as a key feature of the Milestone Funds

Holding a Milestone fund until maturity in order to receive the guaranteed maturity value some years down the road is likely to generate a lower rate of return compared to traditional Target Date funds. This is due to the high allocations to bonds in in the Milestone Funds. From this perspective, as long as equities outperform bonds over the term to maturity, the guarantee does not provide better member outcomes relative to traditional Target Date funds.

It's important to note there is no ‘insurance’ aspect to the guarantee. Milestone funds hold the adequate amount of (zero-coupon) government bonds until they mature.

While the removal of Milestone funds from a plan may be perceived by plan members as a take-away of the guarantee feature, member communications and/or consulting with their advisor on the benefits of other Target Date fund series, is available through Sun Life.

No new fund addition to the Milestone series

Unlike traditional target date fund series which evolve over time, SLGI isn’t adding any new funds with maturity beyond 2060. The Milestone 2060 Fund is the longest dated fund available in the series.

If you continue offering Milestone Funds in your plan, this will affect younger members who will retire after 2060. They won’t have a Target Date option that matches or is close to their expected retirement year.

Increase in operating expenses

The Milestone Funds have operating expenses for both the segregated fund and the underlying fund. The operating expenses are based on total assets in the Funds. As the assets in the Milestone Funds decline over time, their operating expenses will increase for the remaining assets. The segregated fund’s operating expenses may increase up to a maximum of 0.05%. There is no specific maximum limit for the underlying fund’s operating expenses.

In addition, Milestone Funds’ total fees are generally higher than the traditional TDFs given their unique structure.

Maturity process

Unlike traditional target date funds, Milestone doesn’t have a Retirement fund. That means that the maturing fund will transition to either the Guaranteed Daily Interest Account (GDIA) or the money market fund available in your plan in the maturity year. For Milestone 2025, this means that in 2025, the fund will close and money will move to the GDIA or the money market fund available in your plan.

If you offer another TDF series in your plan, you may choose to transfer the money in the maturing Milestone Fund to the Retirement Fund in the other TDF series. If you decide to do so, please provide the instruction to your GRS representative.

What should you do next?

With the update above, please contact your Investment Solutions Executive, GRS representative and/or advisor to discuss this update in further detail and review the target date options in your plan, as part of your ongoing investment governance.

Questions?

Please contact your Sun Life Group Retirement Services representative