Starting and building a registered retirement savings plan (RRSP) could be one of the most important steps you take in your financial life. There is no better way to reduce your taxable income and save for the future. Learn more about growing your savings with these helpful RRSP tips.

RRSP tips

Start your RRSP contributions early

The key to a large RRSP is growth. Growth through contributions and growth through investment earnings. The longer your money is invested, the more it will grow.

Here's an example

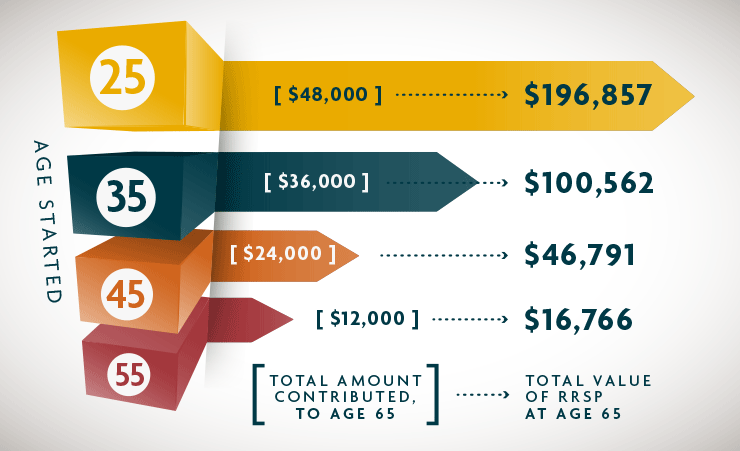

With a $100-per-month contribution, at a 6% annual rate of return, the $48,000 you save will yield nearly $197,000 in 40 years. That's the beauty of investing over a long period of time.

Remember that this is just an example and that there is no guarantee of this rate of return.

What if you start later? To get the same total at age 65, using the same 6% return-per-year assumption, you would need to increase your monthly contribution.

To reach $197,000:

Starting age

35

45

55

Every month you'd need to contribute:

$195

$420

$1,175

Let the power of time work for you. Invest what you can as early as you can. When you retire, you will be happy you did.

More RRSP investment tips

Are you the type to scramble, looking for a few extra bucks to make an RRSP contribution at the end of February? You know you should stop doing that. It's better than not contributing at all, but you're not getting the most out of your money.

Avoid the hype

Stock market returns could be high. Or interest rates could be low. The truth is, when you drop a lump sum into your RRSP in February you have no choice but to accept the current market conditions.

Take a more controlled approach to your investing. Set up a plan and invest accordingly. It will be less stressful and will pay off in the long run.

Spread your investing over the entire year

It's easier to invest in small amounts. Set up your contribution to come directly from your bank account on the day you're paid. You'll be surprised at how quickly things add up – and you won't need to rush around to find a large amount in February.

Remember that your RRSP contribution is an investment in your future lifestyle. A few dollars now will go a long way later, once growth and time are factored in.

If you had to choose between paying the government and paying yourself, most people would say it's a no-brainer: Pay yourself. That's what you're doing when you put money into a tax-deferred investment like an RRSP.

There are definite advantages to RRSPs

RRSPs let you build your retirement savings faster. If you decided to save $1,000 of your earnings for your retirement and you were in a 40% combined tax bracket, you'd really only have about $600 to invest. With an RRSP, you can put all $1,000 into the plan right away.

Your total income is reduced by the amount you invest in your RRSP. By reducing your income, you reduce the tax you have to pay, which leaves you with more of the money you earned.

Sounds good so far. But what about the tax part?

Eventually the government wants its share. With careful planning, you could be in a lower tax bracket in retirement than during your working years. As a result, your income will be taxed at a lower percentage rate and you'll be able to keep more of your money.

Borrowing money to invest in your RRSP can help you reduce your taxable income and could increase your tax refund.

It's an excellent way to grow your retirement savings if you haven't made regular contributions throughout the year. And applying your refund to the loan might reduce your payments and the cost of borrowing the money.

Another option is to take the refund and immediately invest it in your RRSP. This would give you a good head start on your contributions for the next year. That, along with establishing an automatic investment plan, would eliminate the need for you to take another loan next year.

RRSP loans may be a good option to help you build your savings. Talk to your advisor to find out more about whether an RRSP loan is right for you.

When you're behind in your RRSP contributions, a good way to get back on track is to take out a “catch-up” loan.

The best thing you can do for your retirement fund is contribute the maximum allowed by the government. Luckily, if you can't make the maximum, you can carry forward your unused contribution room indefinitely.

RRSP loan logic is simple. Top up your RRSP with money you borrow. Use the refund to pay down the loan and reduce the time it takes to pay it back. The money you invest starts working immediately.

Laddering is a technique used to manage the ups and downs of interest rates. A deposit is split equally among 5 GICs ranging from 1- to 5-year terms. As each GIC matures, you reinvest it in another 5-year term.

This technique ensures 1 investment matures each year, minimizing the interest rate risk and allowing for some liquidity in a portfolio.

Here's an example:

Your initial investment is $10,000.

Divide this amount into 5 separate investments of $2,000 each.

Put each $2,000 into an investment with a 1-year, 2-year, 3-year, 4-year and 5-year term.

When your first investment matures after 1 year, you reinvest that $2,000, plus the interest you've earned, in a 5-year term investment.

Each year, 1 of your investments will mature. You would then reinvest in a 5-year term, possibly benefiting from a higher interest rate and continuing the laddering process.

How can laddering GICs benefit you?

Security in GICs:

- Minimize interest rate risk. By investing in regular intervals, you can reduce your investment risk. Only a portion of your portfolio comes due at any one time. This strategy can limit your exposure to possible fluctuating interest rates.

- Maximize the long-term rate of return. If you convert your investments as they mature to 5-year terms, you can take advantage of the possibility of higher interest rates. Longer-term investments typically offer better interest rates than short-term investments.

- Comfort of guaranteed returns. You're secure in the knowledge that your investments will grow at a constant interest rate, with a guaranteed return at the end of the term.

Flexibility to respond to investment opportunities and financial needs:

- Ability to respond to interest rate changes. You'll have access to 20% of your investments every year. If the interest rates are higher, you can invest in longer-term investments. If interest rates drop or temporarily flatten out, you can minimize your risk, because only 20% of your investments are maturing at any one time.

- Increased availability. Each year, a part of your investment matures and you'll be able to spend it if that's what you need to do. You also have the opportunity to make new investment decisions.

- Ability to choose the maturity dates. You can have specified investments mature when you know you’ll need money for a large purchase or special occasion, such as college or wedding expenses.

It's well-known that the government bases the tax tables on one very simple rule: The more you make, the more they take. But in certain circumstances, you can reduce the amount of tax you will pay in retirement by contributing to a spousal RRSP now.

By splitting your contributions between your RRSP and your spouse's RRSP, the plans will grow in tandem during your working years. Once you retire, you and your spouse can take income from your respective retirement funds and be taxed at an individual rate.

For example, if the two of you decided to enjoy a combined income of $50,000 from your retirement savings, by splitting your withdrawals from 2 accounts you would be able to stay at the lower tax rate applied to individuals earning $25,000 each.

There are no restrictions on how much you can contribute to your spouse’s RRSP as long as you don't exceed your own contribution limit. And your contributions don't affect your spouse's personal RRSP contribution limit in any way.

Asset allocation is a scientific method of investing that tailors your investments to your individual goals and risk tolerance.

There are some basic truths about investing that everyone knows but few actually listen to:

- Market timing is practically impossible and does not work as a strategy over the long term.

- Risk is real, so only take on as much as you're comfortable with.

- Professional money managers know more than you do. That's why they're professionals.

How to invest with asset allocation

- Work with your advisor to figure out what kind of investor you are (there's a questionnaire!).

- Your advisor can help you invest in a mix of assets (cash, guaranteed interest products, equities, etc.) that is diversified and reflects the level of risk you are comfortable with.

- Leave all the day-to-day investment decisions to the pros.

The truth is, wise investors consider market volatility to be their friend.

A highly studied phenomenon called dollar-cost averaging takes advantage of market volatility and has been shown to reduce unit costs and produce higher long-term returns than lump-sum investing.

Sounds too complex? How does this tie into your investment planning? How do you get set up with this dollar-cost averaging deal? It's easy.

Dollar-cost averaging “just happens” when you set up automatic investments into a fund-based plan, where small investments are made regularly over the course of the year.

Your money buys more units when the markets are low. When markets rise again you'll get a much better return on that money. Your whole portfolio may be worth more as a result.

And the more your investment portfolio is worth, the better your retirement lifestyle will be – just what you're looking for.

Get helpful advice

An advisor understands how RRSPs work and can show you how you can structure your contributions and choose your investments to make the most of the benefits offered by this powerful savings vehicle Talk to your advisor or find an advisor today to learn how an RRSP fits into Money for Life, Sun Life Financial's customized approach to your financial and retirement planning.

Tools & Resources

Only advisors who hold CFP (Certified Financial Planner), CHFC (Chartered Financial Consultant), FPI (Financial Planner in Quebec), or equivalent designations are certified as financial planners.