It’s best to leave your RRSP where it is until you retire. But there are a few reasons you may cash your RRSP in early.

How can inflation affect your retirement plan?

No matter where you are on your retirement savings journey, here’s what you need to know about inflation and what you can do to protect your plans for retirement.

Rising inflation coupled with market volatility may have you worried about your retirement savings. How can you save, invest, and retire wisely in an economic environment most of us have never experienced before?

No matter where you are on your retirement savings journey, here is:

- what you need to know about inflation, and

- steps you can take to protect your retirement plan.

How does inflation affect your retirement savings?

Simply put, inflation causes money to lose value over time. Periods of fast-rising inflation—in which prices increase very quickly—can affect your finances:

Your money doesn’t stretch as far.

Inflation is a normal part of our lives, as prices tend to rise over time—typically around 3% every year. Think about how much cheaper your haircut was 10 years ago compared to today. But what happens when inflation is rising much faster than that 3%, and prices skyrocket?

Many of us quickly re-prioritize our spending out of necessity or caution. It can be especially hard for retirees on a fixed income without a cost-of-living adjustment (COLA). It can also be a challenge for those who are further away from retirement. Why? Because spending more to maintain your life leaves less for future savings.

You may need to save less and retire later.

When inflation hits, it’s tempting to reduce retirement savings contributions to meet the rising cost of living. But that’s exactly the opposite of what’s best to stay on track, especially if you’re far away from retirement. There’s also less incentive to save in a declining market.

You may think: “A dollar invested today could equal 90 cents tomorrow, so why bother?” Sure, this attitude has little short-term impact. But it could influence your ability to leave the workforce down the road—even causing you to delay your retirement.

Read more: How much does it cost to retire in Canada?

What’s the effect of inflation if you’re 10+ years from retiring?

If you’re 10 or more years away from retirement, you have time on your side. It's important to continue saving and investing for when you leave the workforce. Remember that inflation will impact prices 10, 20 or 30 years out. That means today’s dollar will buy less in the future. How can you help ensure your retirement savings keep up with rising prices? By saving as much as you can each year and investing wisely over the long term.

Are you on track to meet your retirement savings goal?

Use our Retirement Savings Calculator to find out.

What’s the impact of inflation if you’re close to, or already in, retirement?

Rising inflation can negatively affect both your:

- ability to save more toward retirement, and

- purchasing power in retirement, right when you need it the most.

As prices rise with inflation, the value of your retirement plan savings may stay the same. This leaves you with even less retirement income for what you need and want, especially on a fixed income.

What is purchasing power?

Purchasing power is defined as how many goods and services any currency can buy today. When inflation erodes the value of a dollar over time, this affects your purchasing power. For example: if you needed $1 in 1960 to buy something, you would need $10.11 to buy that same item today.

It’s important to factor inflation and purchasing power into your retirement savings strategy. The more you can save in tax-preferred plans, the better prepared you’ll be to handle rising costs over time.

Read more: 10 ways to beat inflation

How can you protect your retirement from inflation?

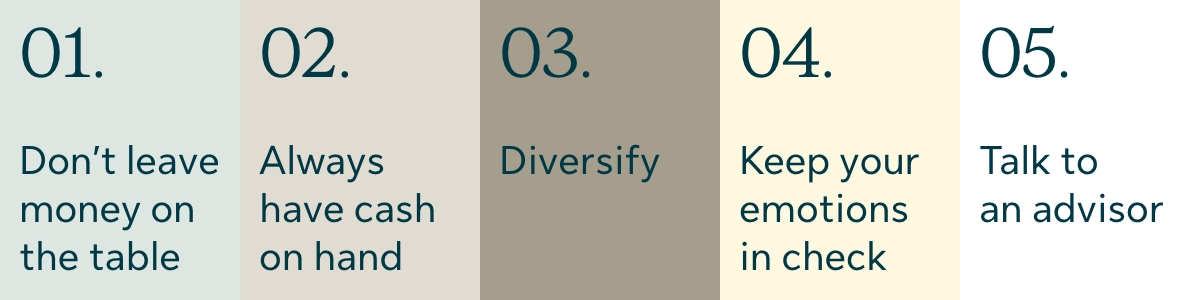

While true in any economic environment, these principles are especially critical during times of rising inflation and market uncertainty:

1. Don’t leave money on the table. If your group RRSP offers matching contributions, keep contributing up to the company match, at least. Remember:

- Consistent contributions take advantage of dollar cost averaging. This can help take the emotion out of investing and minimizes any temptation to try to time the market.

- Regular contributions leverage the power of compounding to take advantage of growth over time.

- Payroll contributions made to your plan are tax-deferred, reducing the amount of income taxes withheld from your paycheque.

2. Have cash on hand for emergencies. Build an emergency fund of three to six months’ worth of living expenses, preferably in a savings account like a TFSA. As we learned during the pandemic, having extra cash on hand for emergencies is paramount. An unexpected car repair, ongoing medical expenses or even a job loss can quickly set anyone back financially.

Building up your savings can help you avoid riskier methods of gathering cash. If you need to start building, or adding to, an emergency fund, consider your spending. Cutting non-essentials (e.g., multiple streaming services, eating out 3x week, etc.) could help build a safety net account quickly.

3. Diversify. Investing across different asset classes can help balance risk and reward while reducing volatility over time.

4. Keep your emotions in check. In a down market—especially coupled with rising inflation—keeping emotions in check can be challenging. Time, not timing, is the best way to capitalize on the markets. Acting impulsively out of fear in the short term can have a significant, negative impact on your retirement portfolio over the long term.

While it seems counterintuitive, try not to check your account balance too frequently. That’s especially important if you’re far away from retirement. An advisor can design a properly diversified retirement portfolio to withstand market ups and downs.

5. Talk to an advisor. If you’re close to, or already in, retirement, now would be a good time to talk to an advisor. They can help you:

- Assess your finances and suggest strategies that may help offset the threat of inflation.

- Explore ideas on how to stretch your retirement income and identify ways to cut costs now and in the future.

- Understand products that provide income each year (accounting for inflation).

- Determine or adjust your sustainable spending rate (the amount you can spend in retirement while maintaining your lifestyle).

- Reassess your plans, adjusting as unknowns become clear or your needs change.

Worried about inflation and your retirement?

An advisor can help you make a plan that helps protect you from inflation.

This article is meant to provide general information only. Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation.