A trip to any store involves quite a bit of sticker shock these days. But going to the grocery store can be particularly jarring. Prices on basic foods seem to jump every week. It can help to understand why this is happening.

At the start of 2023, inflation in Canada started to ease. This drop came after months of inflation hitting record highs. Blame the pandemic that fueled supply shortages and rising demand which pushed up the cost of many products.

Consider these facts:

- The average listed residential rental price for a one-bedroom apartment in Canada soared by 8.6% in December 2023 compared to December 2022.

- A renter paid $2,000 for housing at the start of the pandemic. That renter paid $2,178 in October of 2023.

This shows how inflation dented household budgets in Canada.

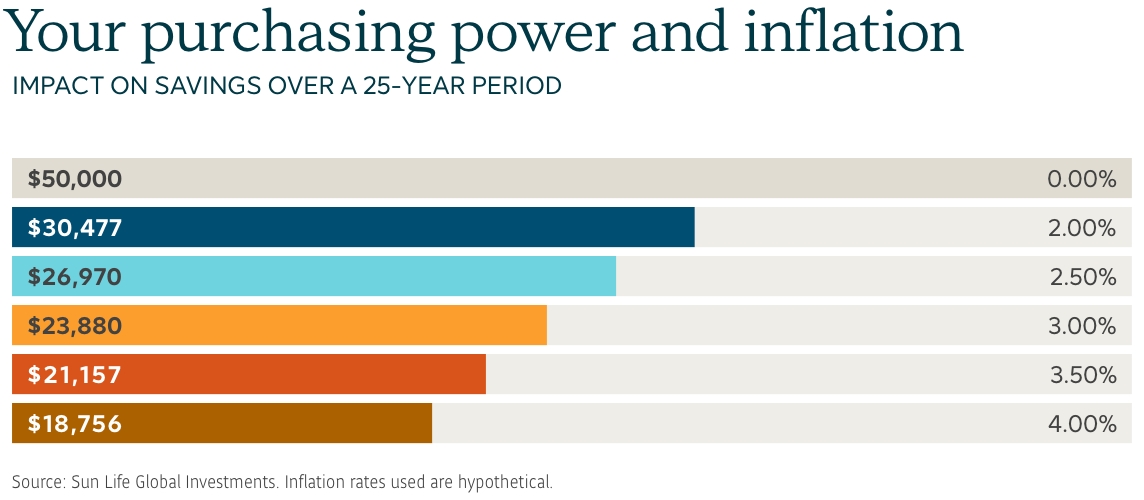

But what effect does inflation have on your investments? The short answer: it can pose a “stealth” threat. Inflation can relentlessly eat away at your savings and investment income.

To help you understand more, in this article we’ll look at:

- what inflation is,

- what causes it, and

- the potential effects on your finances.

Inflation – silently eroding your purchasing power

Simply put, the inflation rate refers to the pace at which the cost of goods and services increases over time. An increase in inflation can be caused by many things. That includes supply shortages and rising demand, like we saw with lumber. Or it may be a sharp rise in production costs, including raw material and wages.

Consumers often end up paying for these rising costs. For example, when the price of oil rises there is an almost immediate increase at the gas pump.

To calculate Canada’s inflation rate, Statistics Canada created the Consumer Price Index (CPI). It assesses the cost of over 700 products every month, including food, clothing, housing, and education. The components of the CPI constantly fluctuate. And in the 43-year-period from December 1980 to December 2023:

- Canada’s average annual inflation rate was 3.08%.

- Or as the Bank of Canada (BoC) puts it, the value of money fell by 3.08% annually.

This means, on average, something that costs $100 this year would cost $104 the next year. Sure, if you’re working, your wages may rise to keep pace with inflation. But what if you’re retired and on a fixed income, and don’t have a COLA (cost-of-living adjustment)? Then your purchasing power (the amount of goods and services you can purchase) declines steadily over time.

Inflation has been more than double the average recently. So more than ever, consumers are paying closer attention to prices and trying to get more for their dollar.

How does inflation affect bonds and investment decisions?

We’ve looked at how inflation erodes your purchasing power. But how will your investments hold up to inflation? The short answer? It depends on what investments you’re holding.

Let’s start with bonds, and how they react to inflation. Among the most widely held bonds are those issued by governments. These are high quality and backed by a low default rate. Hence, they are investment grade bonds and must carry a BBB credit rating or higher.

These bonds are attractive for both the income they produce and their lower risk profile. To that end, institutions, pension plans and investment managers often hold them to lower risk in their portfolios. For example, traditionally, to offset the risk inherent in equites, a balanced mutual fund would hold 40% in bonds and 60% in stocks.

Nevertheless, returns on bonds can be negatively affected by inflation in a couple of ways:

- First, depending on the interest rate, if you received an annual payment of $200 a year on your bond, you would be able to buy less and less each year with it.

- Secondly, rising interest rates can hurt these bonds. This may occur when inflation is running above the BoC’s 2% inflation target. To slow inflation, it could force the bank to raise its key lending rate.

It sounds counterintuitive, but when interest rates rise bond prices fall. Bonds with longer maturity dates (such as a 20-year bond) are particularly vulnerable to rising rates. Why is this?

Let’s say your 20-year, $10,000 bond comes with coupon rate of 5%. The coupon rate is the annual income you can expect to receive. A problem occurs if interest rates jump. In that case, new 20-year bond issues coming to market might have a higher coupon rate. If so, new buyers would obviously opt for the higher coupon. This, in effect, would reduce your bond's value with it now selling at a discounted price.

Alternatively, there are classes of bonds indexed to inflation. Two of the most widely held include floating rate bonds and treasury inflation-protected securities (TIPS).

Unlike most bonds that have a fixed interest rate, these types of bonds carry a variable coupon rate. For example, the interest rate on a floating rate bond links to a benchmark rate. That’s the situation with the U.S. Federal Reserve’s key overnight rate. When the Fed rate rises, so will the interest paid on a floating rate bond.

How does inflation affect stocks?

Like bonds, the effect of inflation in your stock portfolio depends on how you invest. Let’s begin by looking at dividend-paying stocks, a source of income for many investors. They usually pay on a quarterly basis, from a company’s cash flow or profits. And often range from 1 to 10%.

How are dividend payouts affected by inflation? Some companies, such as a utility, may perform well in an inflationary environment. That’s because they can pass rising costs on to consumers. This allows them to increase their dividend payouts. Consider if inflation is running at 3%. If a company increases its dividend to 5%, you could come out ahead.

The opposite would be true if rising costs triggered by inflation force a company to cut its dividend. So again, how inflation affects dividend income comes down to what dividend-paying stocks are in a portfolio. That’s why dividend fund managers put great effort into analyzing a company before they invest. They want to find out if the dividend the company pays is sustainable and may increase over time.

Read more: 10 ways to beat inflation

Inflation hedges: commodities and property

Remember what’s in a portfolio will go a long way to determining how it stands up to inflation. To that end, when inflation is rising, investment managers may invest in companies such as a utility. Or it could be a company manufacturing an essential product and can pass rising costs on to consumers.

They may also invest in specific asset classes, including infrastructure and real assets. These have traditionally performed well in an inflationary environment. For example, the Canada Pension Plan has a broadly diversified mix of investments.

Real estate investment trusts (REITs), which trade like equities, have traditionally been an option to hedge inflation. This is because physical assets such as a house often grow with or above the rate of inflation. This, in part because supply often outstrips demand for both personal and rental use. Moreover, if an individual buys a house at a fixed interest rate, inflation becomes an ally. This is because as wages rise with inflation, the fixed cost of the loan becomes more manageable.

Commodities typically rise when inflation accelerates. This was the case in 2022 when commodities returned 22% - the top performing asset class. Another example is energy prices, which generally move in the same direction as inflation. Energy was a rare outperformer among the 11 sectors of S&P 500 index in 2022. That year, the S&P 500 fell almost 19%. But the energy sector in the index soared 59%, offering some much-needed respite in an inflationary environment.

Offsetting inflation requires a plan

As we’ve shown here, inflation can erode your purchasing power. But as we’ve also noted, it’s what’s in a portfolio that matters when inflation rises. That’s why the best advice is to meet with an advisor. They have the ability to assess your finances and suggest strategies that may help offset the risk that inflation poses.

This article is meant to provide general information only. Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation.

This article is meant to provide general information only. It’s not professional medical advice, or a substitute for that advice.