You can start collecting your CPP and OAS benefits in your early 60s. But is it better to hold off for another few years? Here’s what to keep in mind before you tap into these pensions.

How to avoid running out of money in retirement

The amount you’ll need in retirement is unique to you, and the right financial plan can set you up for success. Here are 5 ways to get started.

“To retire, you need a million dollars.”

You may hear that statement a lot. In truth, there’s no magic number (although there are some simple guidelines to follow). Financial goals and lifestyle, location, as well as life expectancy and cost of living, vary from person to person. All of those, and more, will factor into how much you truly need. With so many things to consider, you may wonder if you’re saving enough and how long that money will last you!

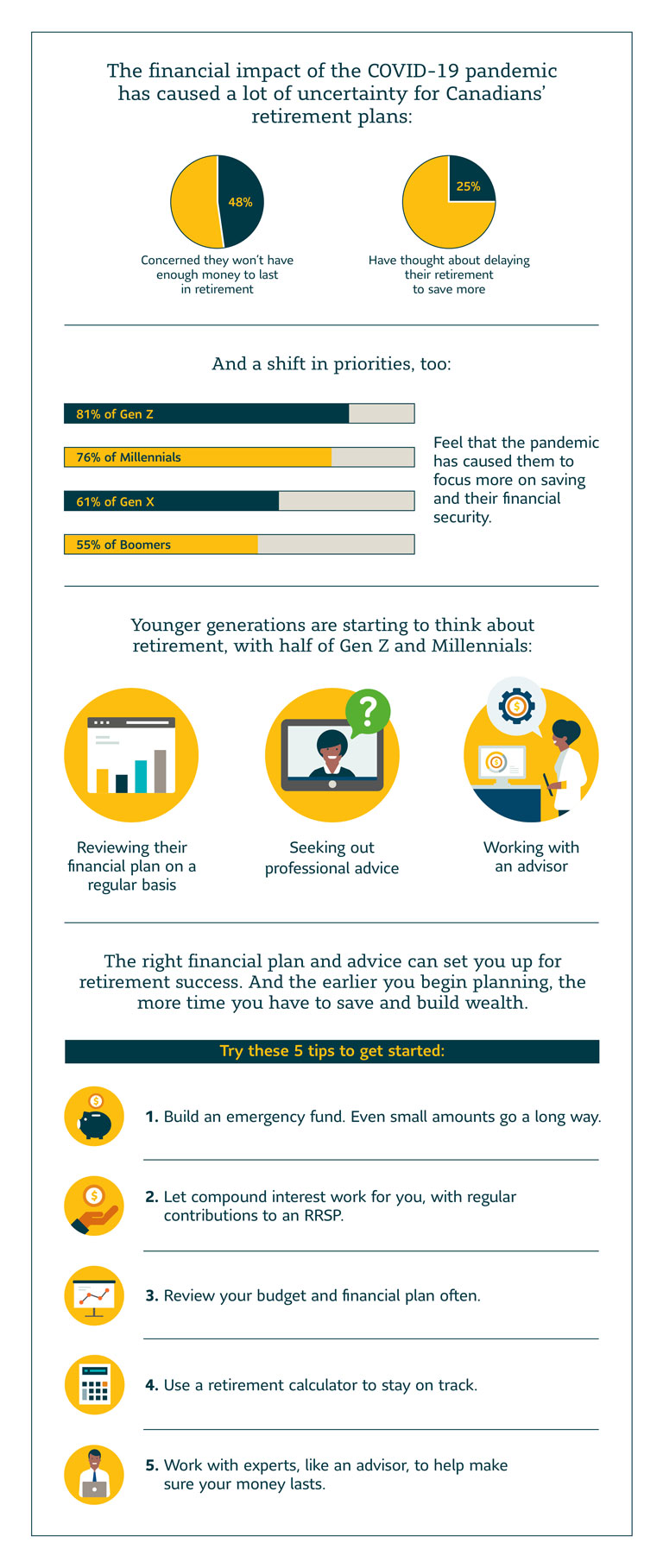

The financial impact of the COVID-19 pandemic has caused a lot of uncertainty for Canadians’ retirement plans:

- A quarter have thought about delaying their retirement to save more

- 48% are concerned they won’t have enough money to last in retirement

And a shift in priorities, too:

|

Feel that the pandemic has caused them to focus more on saving and their financial security. |

Younger generations are starting to think about retirement, with half of Gen Z and Millennials:

- Reviewing their financial plan on a regular basis (Gen Z 62%, Millennials 54%)

- Seeking out professional advice (Gen Z 44%, Millennials 51%)

- Working with an advisor (Gen Z 47%, Millennials 32%)

The right financial plan and advice can set you up for retirement success. And the earlier you begin planning, the more time you have to save and build wealth.

Try these 5 tips to get started:

- Build an emergency fund. Even small amounts go a long way

- Let compound interest work for you, with regular contributions to an RRSP.

- Review your budget and financial plan often.

- Use a retirement calculator to stay on track.

- Work with experts, like an advisor, to help make sure your money lasts.

And remember: if you haven’t started yet, it’s never too late! Canadians who work with an advisor are more likely to be confident about their financial future and feel better prepared for retirement.

Find an advisor today – they can help you do the math on how much you actually need to retire, and keep your savings on track.

Need help figuring out what’s right for you?

An advisor can help put together a solid plan that suits your goals.

Sources:

- Benefits Canada, A quarter of Canadians delaying retirement due to pandemic: survey

- Healthcare of Ontario Pension Plan (HOOPP), 2021 Canadian Retirement Survey

- Sun Life Canada, Pandemic driving younger Canadians to protect their financial future more then ever

- Wealth Professional, Canada's selfie generation leads the way in financial self-assessments