Most of us will enter retirement with a pretty good understanding of our current health and what it takes to manage it. But, as time goes on, everyone’s health changes and we gradually begin to spend more on our medical, physical and personal care needs.

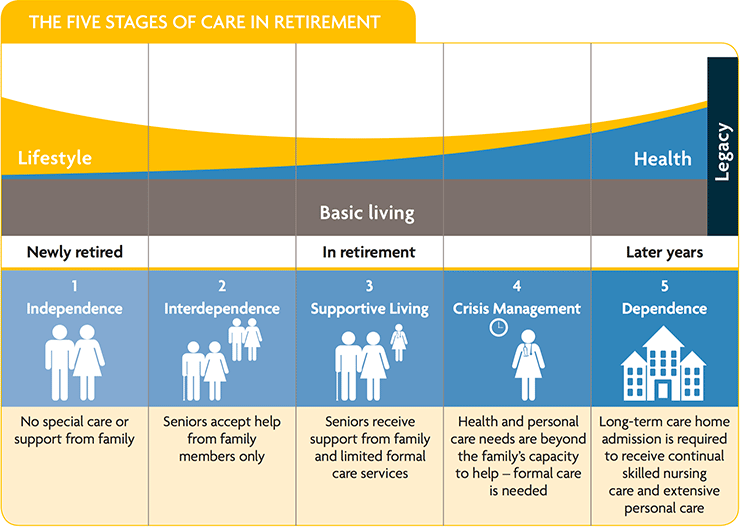

Typically, we move through 5 stages of care as we age. The progression through these stages is different for everyone but, in time, your health needs and costs will grow. For many of us this means we’ll eventually become dependent on a friend, family member or professional caregiver for help.

Whatever the care, the funding is your responsibility – long-term care services are not part of the Canada Health Act, and government-subsidized care is very limited.

As Canadians, understanding these stages is particularly important because we're living longer than ever before. As you build your retirement income plan, it's important to consider both lifestyle and life stage choices.