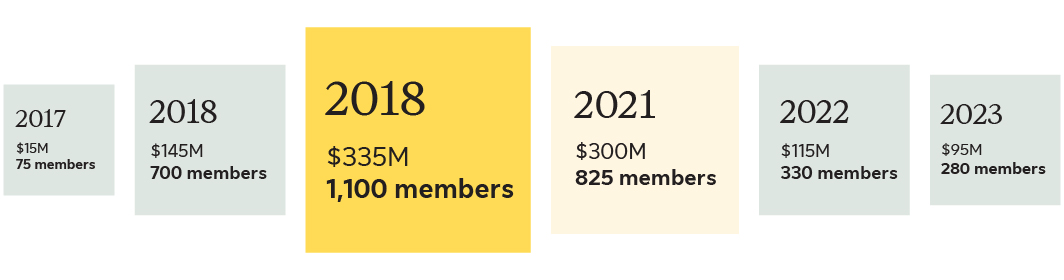

West Fraser’s pension de-risking journey

2017 – Their first transaction was an annuity buy-out for two small, closed plans. Two insurers split the transaction totaling $15 million. This was a learning experience for West Fraser that helped identify the steps needed to ensure successful transactions going forward.

2018 – West Fraser came to market with another annuity buy-out transaction. Two larger closed plans totaled $145 million, and the transaction was split between two insurers.

Building on this success, West Fraser came back to market later that year for two open plans. These Canadian salaried and hourly plans were West Fraser’s largest plans valued at $335 million. This annuity transaction transferred risk to two insurers, substantially reducing the number of retirees West Fraser was responsible for paying.

2021 – West Fraser confidently returned to market with a complex deal including seven open and closed plans. One of these plans was even a joint venture with a partner. Three insurers split the $300 million transaction.

2022 – Rising interest rates closed the pension funding gap and market conditions allowed for more affordable pricing. West Fraser de-risked an hourly open plan with inflation-linked liabilities worth $115 million with one insurer.

2023 – West Fraser came to market once again to purchase a $95 million annuity buy-out with one insurer. This transaction protects pension benefits for recent retirees of plans they previously de-risked with group annuity purchases.

West Fraser annuity purchases