If your business strategy is succeeding:

Life’s brighter under the sun

© Sun Life Assurance Company of Canada. All rights reserved.

One way of looking at pension risk is to think about your defined benefit (DB) pension plan as a division in your company. It provides a product (an annuity) to a group of customers (your pension plan members). The business strategy of many DB pension divisions is to take risk in equity and bond markets. The hope is to earn excess returns and reduce the cost of providing pensions. There are innovative, affordable de-risking solutions that can help you manage these risks in your pension plan.

The business strategy involves taking risks, which can offset each other. For example, a successful bet on equities could be offset by an unsuccessful bet on interest rates. For the strategy to be successful, the pension plan needs to consistently place successful bets.

If your business strategy is succeeding:

If your business strategy is failing:

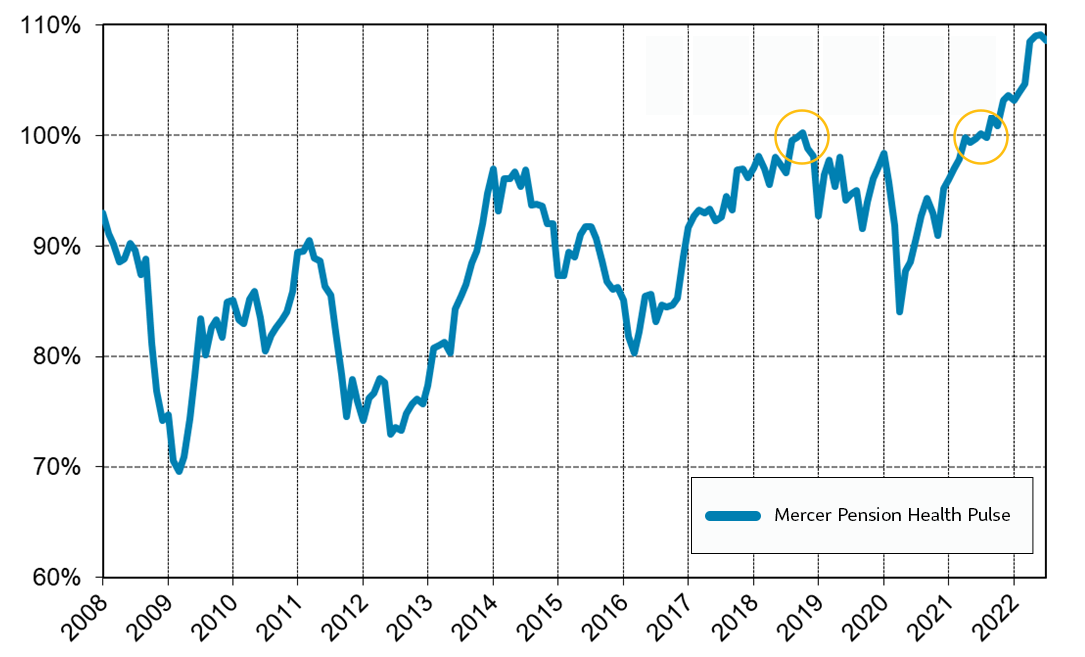

The Mercer Pension Health Pulse shows funding levels of most pension plans took a wild roller coaster ride over the past 16 years. Since 2008:

Source: Mercer Pension Health Pulse published July 2, 2024

With many risks and challenges in managing a DB pension plan, many plan sponsors are taking action to de-risk their plans and transfer pension risks to an insurer.