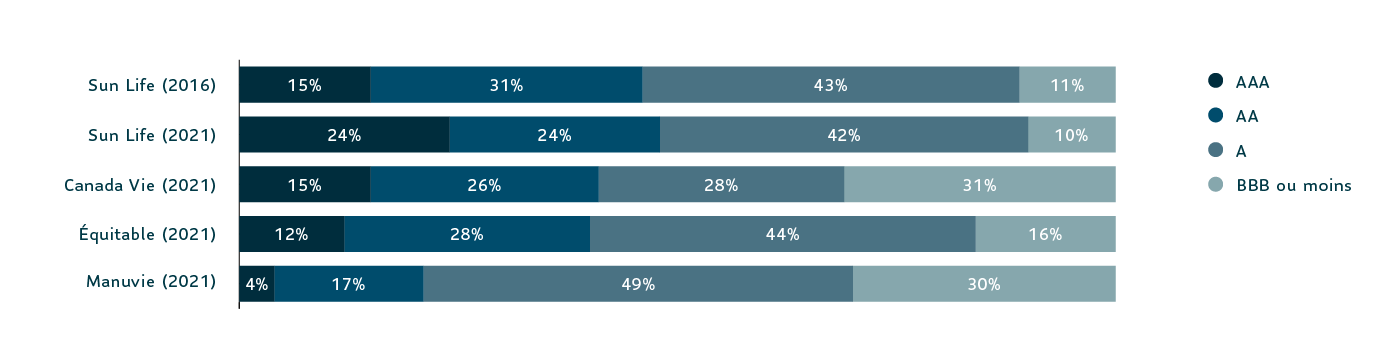

Spreads have been low over the last few years but are now starting to widen. Sun Life may shift some liquid assets opportunistically toward lower grade bonds to capitalize on the improved risk-adjusted returns.

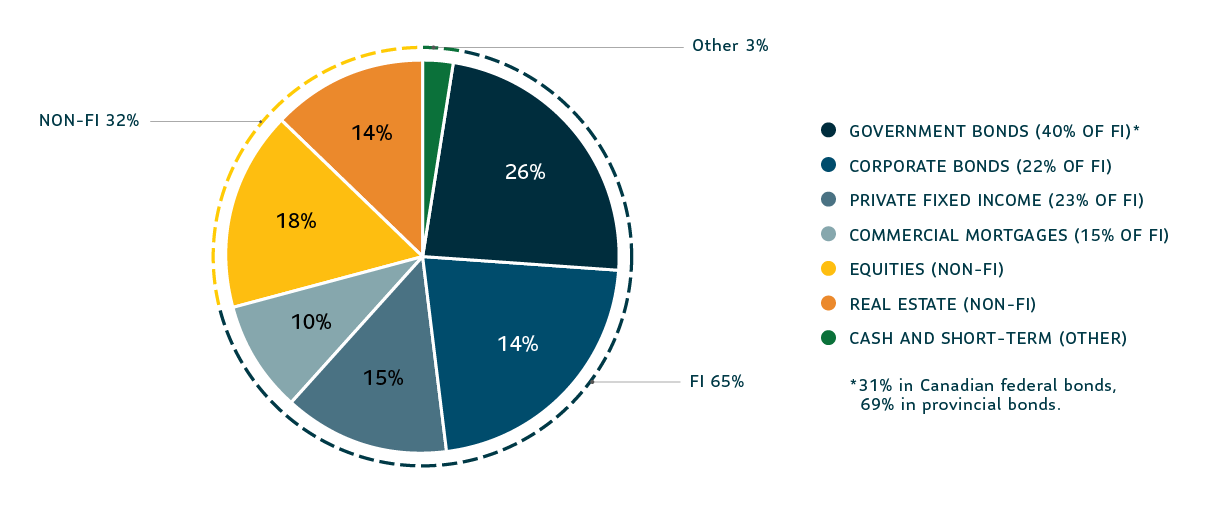

Sun Life’s prudent fixed income investment philosophy

We have a lower proportion of assets maturing in the current low interest rate environment as compared to other insurers. We believe lower-quality bonds have been inadequately compensated for their increased risk because of recent spread compression. As such, our significant percentage of high-quality bonds has positioned us well. We foresee a widening of spreads in the future. The increased liquidity of our high-quality assets puts us in a strong position to jump on opportunities. We actively manage our Par account to seek quality investments while staying within our target guidelines.

Download Competetive Edge: Fixed Income Quality and Duration PDF