I am myself a Gen Zer. I have lots of dreams and ambitions for the future. But sometimes it’s hard to look ahead in the current economic climate. How long will I have to save to buy a house? How can I save for my projects while avoiding FOMO? Will I ever be able to buy a condo on the Costa del Sol? Of course, you could say that I have my whole life ahead of me. I am nevertheless aware of the challenges facing my generation.

As a Sun Life employee, I’m fortunate to be surrounded by a host of professionals who can advise me. If this sounds like you, you’re not alone! These concerns are on the minds of most Gen Zers. The good news is that there are many ways to build a solid savings strategy. And with a good strategy, you’ll experience less financial anxiety. Here are a few of them.

Who is Generation Z?

Generation Z is made up of people born between 1996 and 2010. It comes after Millennials (Generation Y) and before Generation Alpha. It is often described as the first “constantly connected” generation in history. This cohort has a close relationship with technology and knows how to use it to its advantage. We’re generally more adept at searching the Internet quickly and efficiently. Because we’ve been immersed in the Internet, it’s also easier for us to detect and avoid traps.

What are the main financial challenges facing Generation Z?

Deloitte conducted a survey of 14,483 members of Generation Z in 44 countries. Among this group, 51% said they lived from paycheque to paycheque. The rising cost of living remains the number one societal concern of my generation.

One positive finding of this survey is improved satisfaction with work-life balance. In other words, Gen Zers highly value flexibility and well-being at work. Many of us, for example, are turning to hybrid or remote jobs. This is a big step forward for my generation. I find that inspiring. Work should not only be an obligation, but also a source of fulfillment and balance in life. What’s important is overall quality of life. This includes personal well-being and the ability to plan and save for the future.

The financial world is becoming complex. There are a lot of savings solutions, account types and investment options. There are fewer and fewer defined-benefit pension funds. We don’t know where to start! One positive for our generation is the increase in QPP contributions this year. They will increase by 7.7% over the 2023 maximum contribution. The contributions we make to the Quebec Pension Plan (QPP) over the years are retirement savings that gradually increase in value. The increase will have a positive impact on our retirement savings, but it won’t be enough to guarantee our financial security.

As a result, future generations will have to navigate an increasingly complex economic environment.

As if we didn’t already have enough to deal with, other challenges have been added, including:

- High inflation

- Rising interest rates

- Rising rents and house prices

How to build a solid savings strategy

Faced with these challenges, it’s normal for Generation Z to feel financial pressure. My friends and I sometimes talk about postponing major purchases like a house. Some still live with their parents, trying to save on rent and expenses. Others have difficulty saving when they rent. What’s more, student debt incurred to finance higher education weighs heavily on many Gen Zers. This leads some of them to rethink their education. As a result, they tend to postpone getting a master’s degree or PhD. This combination of financial pressure and uncertainty about the future leads some Gen Zers to adopt a “carpe diem” mentality. They live in the moment, indulging in small pleasures, because their big goals seem out of reach in the short term.

But it’s important to point out that despite these obstacles, there are savings solutions tailored to our reality.

Can we still dream of buying a house? Absolutely! Financial security advisor Christiane VanBolhuis points out that “it’s totally accessible with the right game plan. This will ensure the best use of our limited resources. However, it’s important to give ourselves the means to achieve our goals.”

What’s a good game plan?

Basically, it’s an overview of your financial situation. First, an advisor will take the time to get to know you to better understand your situation. You’ll put down on paper a list of your assets and debts. Next, you’ll build your plan together based on your needs. Let’s say you want to save for a big trip. You can start by creating a budget that covers your essential and non-essential expenses. Ideally, your financial plan will cover all the important elements of your financial life, including:

- Savings

- Debt repayment

- Investments

- Retirement

5 tips to start saving

To set yourself up for success, regardless of your goals:

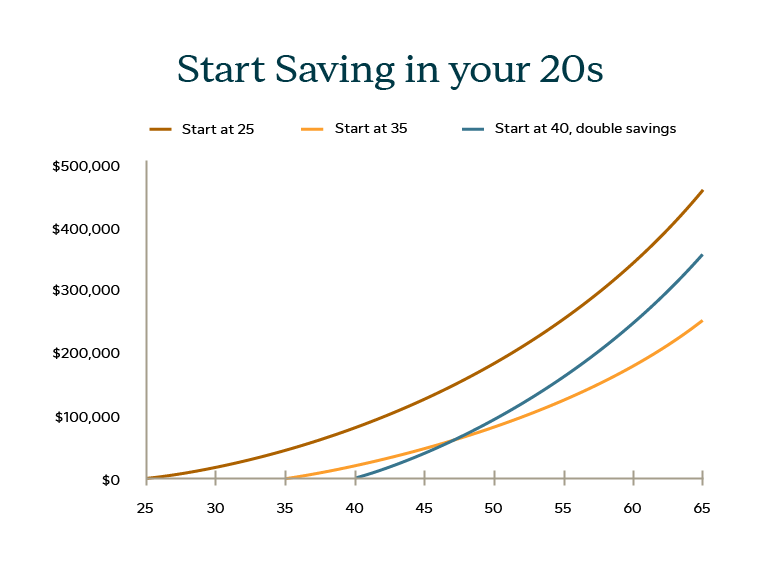

1. Start early

According to Ms. VanBolhuis, that’s the most important thing to remember. Even if you save small amounts at first, you have to start somewhere. This will put you in a better position to achieve your goals. And let’s face it—we have the magic of compound interest on our side. The earlier you start, the more your money fluctuates.

Source : Business Insider

2. Take advantage of your group insurance plans

Are you fortunate enough to have access to a group insurance plan? Make the most of it! Investing in your physical and mental health isn’t just a pillar of your well-being. It can also have huge benefits for your financial health. These are intrinsically linked concepts. Investing in yourself means, for example:

- Scheduling annual checkups

- Playing sports or meditating regularly

- Attending financial literacy courses/webinars

- Meeting with a nutritionist

Being physically and mentally healthy makes you more productive and confident. And vice versa. If you suffer from financial stress, chances are it will affect your health. This can include headaches, insomnia, anxiety, depression and so on. That’s why it’s important to listen to your body and take advantage of the resources available to improve your well-being.

3. Take advantage of your employee pension plan

Joining an employee pension plan is a great way to save for your retirement. And it’s even better if your employer also contributes to your plan. Your savings will grow faster.

4. Open a TFSA

No one is immune to unforeseen financial circumstances. That’s why it’s important to build an emergency fund. A TFSA can be a good way to save for uncertainty. You can contribute in cash or through investments such as:

- Bonds

- Stocks

- Mutual funds

As an added bonus, this account lets you save tax-free (TFSA income - interest, dividends or capital gains - is tax-free).

Want to save for a home? To start your own business? To travel? You can also achieve these.

5. Meet with a financial advisor

You may be wondering whether an advisor will take care of you if you don’t have a lot of money to invest. In fact, many advisors offer services tailored to young people with limited budgets. They understand young people’s financial challenges and can tailor their solutions to different income levels.

Among other things, an advisor can:

- Help you manage your budget

- Help you set your financial goals

- Offer you personalized savings and investment solutions

Even if retirement seems a long way off, it’s a good idea to spend time talking to an advisor. It’s a good way to develop your financial literacy. The tools you’ll acquire are the foundations that will guide you throughout your career and personal life. As your situation changes, you’ll be able to adjust your savings strategy and insurance. “When we work with a Client, we really take a 360-degree look at their situation. We get to know their objectives and priorities. Then, together, we look to see whether the strategies we’ve put in place are in line with their objectives,” says Ms. VanBolhuis. Life changes, and so do our personal circumstances. That’s why it’s important to adjust our plan along the way.

This article is meant to provide general information only. Sun Life Assurance Company of Canada does not provide professional legal, accounting, tax or other professional advice. Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation.

1 Christiane Van Bolhuis, financial security advisor, group insurance and group annuity plan advisor and financial planner, Solutions financières Wallace & VanBolhuis inc., distributor authorized by Sun Life Assurance Company of Canada.

* Mutual Fund Representative, Sun Life Financial Investments (Canada) Inc.

Sun Life Assurance Company of Canada is the insurer, and is a member of the Sun Life group.

© Sun Life Assurance Company of Canada 2024.