Website maintenance starting Friday April 19 @ 9pm ET

The secure site and tools will be temporarily unavailable starting Friday April 19 @ 9pm until 9pm on Saturday April 20 ET for system maintenance. Thank you for your understanding.

Website maintenance starting Friday April 19 @ 9pm ET

The secure site and tools will be temporarily unavailable starting Friday April 19 @ 9pm until 9pm on Saturday April 20 ET for system maintenance. Thank you for your understanding.

Use Sun Life Illustrations to illustrate a critical illness insurance with the following information:

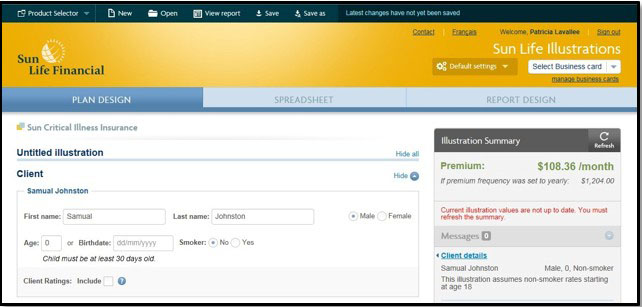

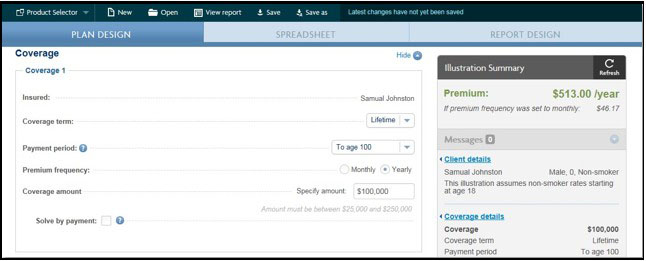

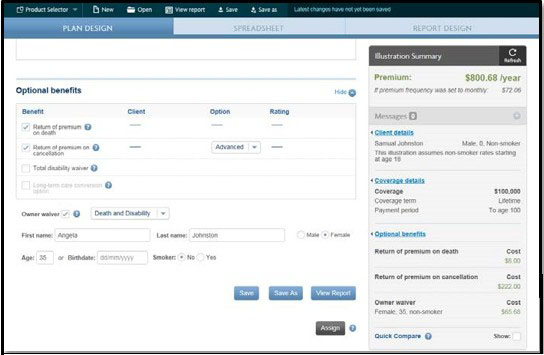

Clients are Mark and Angela Johnston. They are 35 years old, married and non-smokers. They want lifetime protection for their son Samual with a coverage amount of $100,000. Client Samual Johnston, 0 year old non-smoker male

Coverage

Optional benefits

Important!

We are continuously enhancing Sun Life Illustrations, therefore, the slides illustrated in this training material may differ from the software.

1. Open your Sun Life Illustrations desktop or web version.

2. From the Sun Life Product Selector page, select the Sun Critical Illness Insurance link. The Sun Life Illustrations page opens and defaults to the PLAN DESIGN tab.

Under the Client section, enter Samual’s information. For Age, enter 0. Or you can enter the child’s birthdate.

3. You will get the message that the child needs to be at least 30 days old which is fine.

4. For Smoker leave the default of No selected.

This means that after age 18, non-smoker rates will be applied in the illustration. If you choose Yes, than after age 18, smoker rates will be applied in the illustration. It’s important to note and explain to the client that starting at the policy anniversary nearest the child’s 18th birthday, smoker rates will apply. It will be the owner’s responsibility to apply for non-smoker rates.

5. Under the Coverage section for:

6. Click the Refresh button to recalculate the premium as you enter information.

7. Under the Optional benefits section:

Tip: The Quick Compare, when selected, shows you at a glance what the cost would be based on each comparable term and payment period. This comparison only shows the initial premium.

8. Click Save.

9. From the Save illustration dialog box, in the Illustration name field give the recommended name of Firstname Lastname Product Coverage amount and then click Save.

10. Select the REPORT DESIGN tab, and select all the options under Client Report Options.

11. From the Report, durations drop down list, select First 20 years and every 5th after.

12. From the Quick links section, select the Guide to critical illness definitions link and print for the client.

13. Click the View Client Report button and from the View Downloads window click Open.

14. From the File menu, select Save As.

15. From the Save As PDF window, in the File name field enter the recommended name of Firstname Lastname Product name report.

© Sun Life Assurance Company of Canada. All rights reserved.