Website maintenance starting Friday April 19 @ 9pm ET

The secure site and tools will be temporarily unavailable starting Friday April 19 @ 9pm until 9pm on Saturday April 20 ET for system maintenance. Thank you for your understanding.

Website maintenance starting Friday April 19 @ 9pm ET

The secure site and tools will be temporarily unavailable starting Friday April 19 @ 9pm until 9pm on Saturday April 20 ET for system maintenance. Thank you for your understanding.

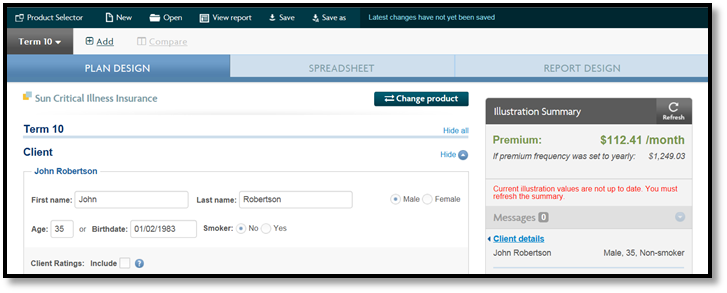

John has contacted you and set up a meeting to discuss critical illness insurance to ensure he’s protected. You completed a needs analysis and John needs $100,000 critical illness coverage.

In this case study, you’ll compare three different options that you will be going over with John.

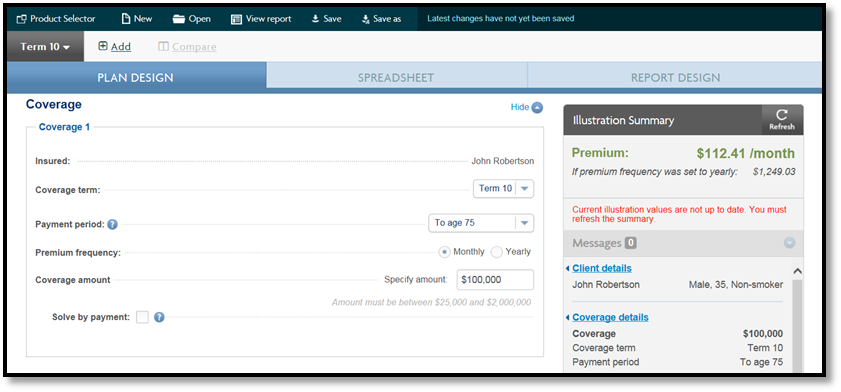

Use Sun Life Illustrations to illustrate a Sun critical illness with the following information:

Client

Coverage

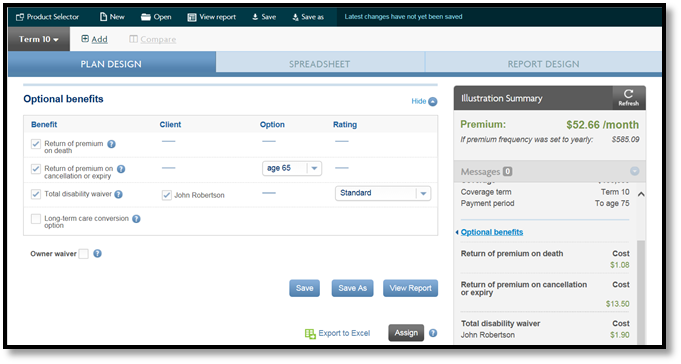

Optional benefits

Important!

We are continuously enhancing Sun Life Illustrations, therefore, the slides illustrated in this training material may differ from the software.

Creating an illustration in Sun Life Illustrations:

1. From your desktop, double click the Sun Life Illustrations Web icon.

The Sun Life Illustrations Home page opens.

2. From the Start a new product illustration drop-down list, select Sun Critical Illness and then click Go.

Since we are going to be comparing three different options for John, you will need to rename the Illustration 1 tab to make it easier for you and the client to see each option.

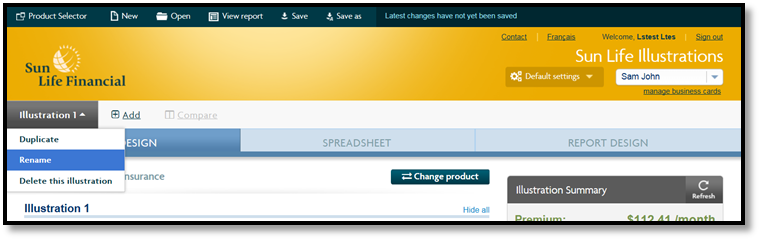

3. Beside Illustration 1, click the arrow for the drop-down list and then click Rename.

4. Enter Term 10 and then press Enter.

5. Under the Client section, enter John’s information.

6. Under the Coverage amount section in the:

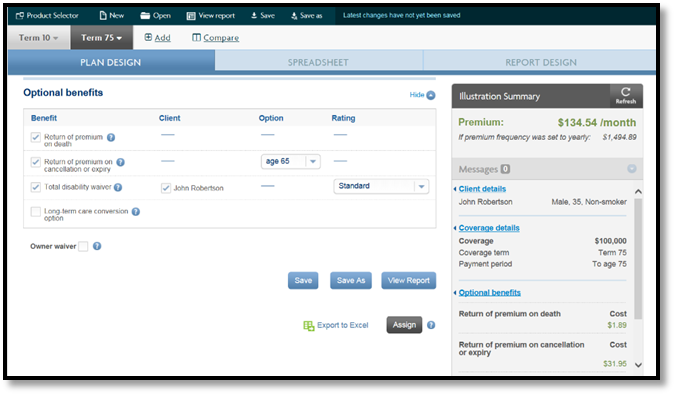

7. Under the Optional benefits section:

8. Under Illustration Summary, click the Refresh

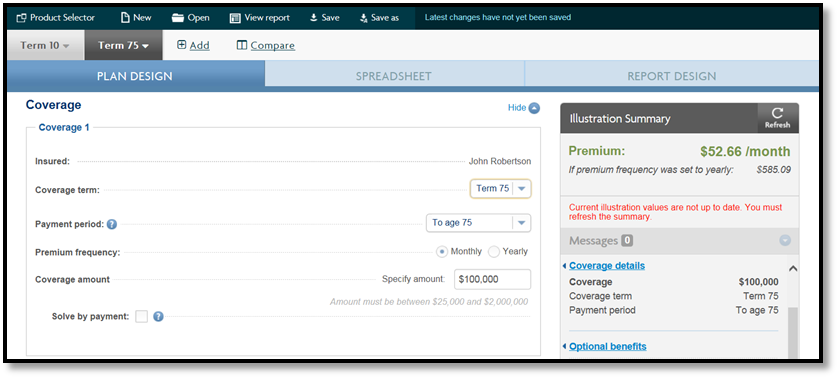

The premium for the first option, is $52.66 a month. Now let’s add a second option for the Sun Critical Illness.

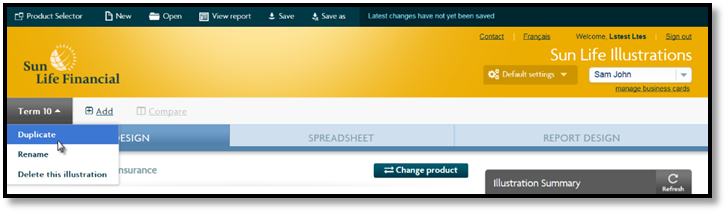

9. Beside Term 10, click the arrow for the drop-down list and then click Duplicate.

10. Beside Illustration 2, click the arrow for the drop-down list and then click Rename.

11. Enter Term 75 and then press Enter.

Coverage

Optional benefits

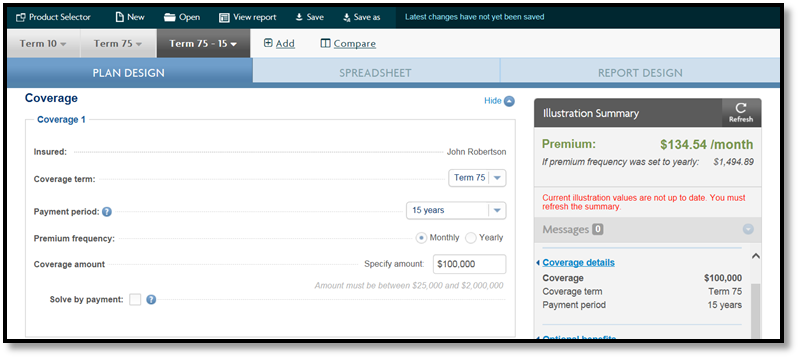

1. Under the Coverage amount section for:

2. Under the Optional benefits section leave:

3. under Illustration Summary, click the Refresh

The premium for the second option is $134.54 a month. Now let’s add one more option:

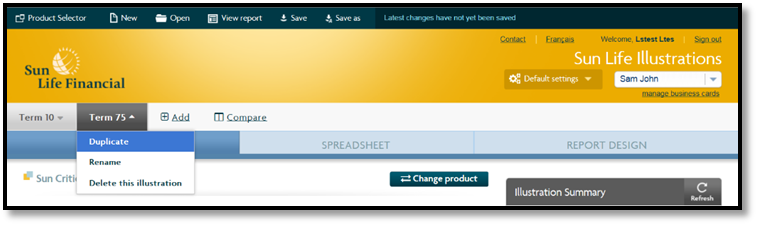

4. Beside Term 75, click the arrow for the drop-down list and then click Duplicate.

5. Beside Illustration 3, click the arrow for the drop-down list and then click Rename.

6. Enter Term 75 - 15 years and then press Enter.

Coverage

Optional benefits

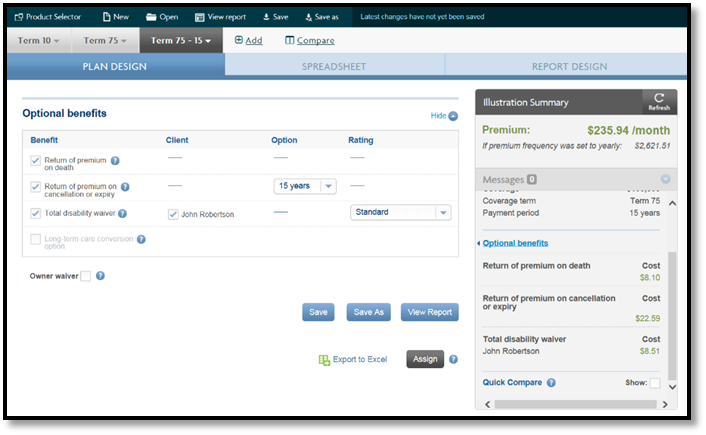

1. Under the Coverage amount section:

2. Under the Optional benefits section leave:

3. under Illustration Summary, click the Refreshbutton

The premium for this third option is $235.94 a month.

Tip!

When you select the Quick compare option from the bottom of the Illustration Summary and you open the quick compare report, a high level cost and breakdown of benefit cost is displayed. It shows 5 year interval policy anniversary premiums.

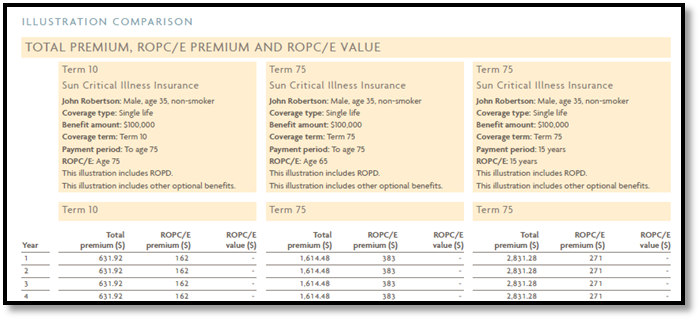

When you select the Compare link from the illustration and display the compare report, it displays the annual premium for all benefits. However, it will provide a breakdown of the ROPC/E premium and value only. It does not display a breakdown of the other benefits costs.

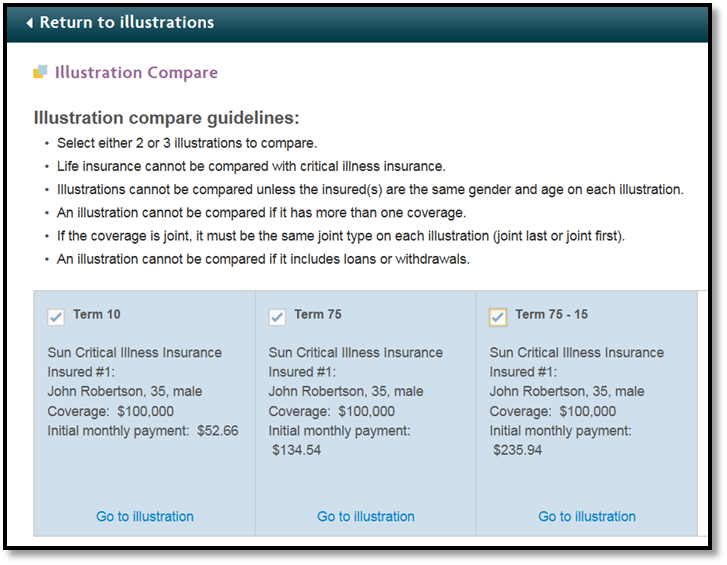

4. From the tab area, click Compare.

5. Select 2 or 3 illustrations to compare.

If you want to make a correction to the illustration or if the error message Calculations in illustration needs to be refreshed before they can be compared, click the Go to illustration link.

Important:

When selecting the illustrations to compare, the premium shown is based on the frequency selected for each illustration.

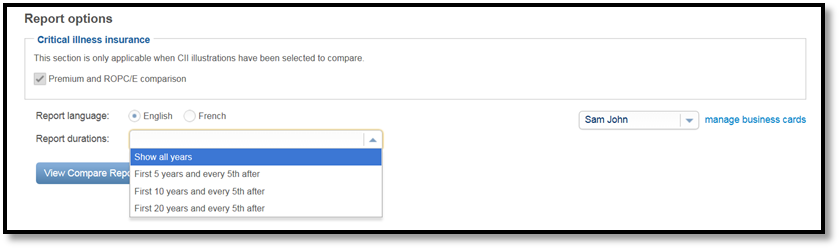

6. From the Report options section:

7. Click the View Compare Report

8. Click Open. The report opens in the Adobe Reader.

Important:

The Total premium is always based on the annualized amount for all illustrations being compared.

9. From the File menu, click Save as.

© Sun Life Assurance Company of Canada. All rights reserved.