OF THE PAR DSIR

Elements that affect policyholder dividends

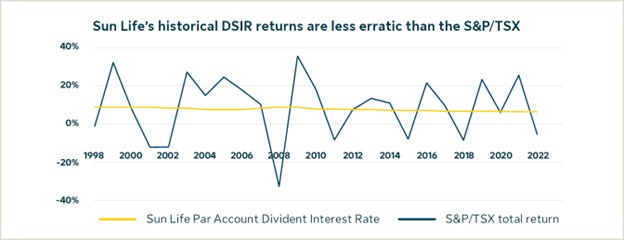

The dividend scale interest rate (DSIR) is influenced by the performance of the participating (Par) account investments which has the largest impact on the dividends available to policyholders. It is not the yield of the Par account. Sun Life sets it by looking at recent investment experience and our realistic expectations for returns in the near future. Unlike some other insurers, Sun Life applies the same DSIR to all Par policyholders, including those in the open and closed block.

Standard deviation

Standard deviation is how we measure the volatility of the DSIR over time. Although past performance does not guarantee future performance, an investment with a lower historical standard deviation is indicative of lower risk. This is because its returns have been more stable. Stability is important because it allows you to have confidence in the values that you illustrate.

Comparing Sun Life’s low DSIR volatility to alternative investments

The DSIR of Sun Life’s Par has historically experienced lower volatility in comparison to major benchmarks, including Par dividend scale returns from other Canadian insurers. Over the past 25 years, the standard deviation of Sun Life’s DSIR was just 0.85%.