When the stock markets drop drastically, it's natural to want to do something to reduce the volatility. Perhaps you want to sell your investments or make changes to your portfolio. But if you already have a diversified portfolio*, that may not be the best thing to do right now.

"If you have a diversified portfolio and your financial objectives haven't changed, then the best course of action is to stay invested in the markets," says Sun Life advisor Brian Burlacoff.

Article contents:

Need advice about what to do when the stock market goes down?

A Sun Life advisor can help.

Why stay invested, even in a volatile market?

Because historically the markets have bounced back and recovered.

Many different events have sparked volatility in the past. Look to history as a guide. Think of Black Monday in 1987, the Tech Meltdown of 2000 or the Financial Crisis from 2007-2009. In all these cases, you’ll see a cycle.

"When markets become volatile, they move to the downside, but then they recover," Burlacoff explains. "The pattern here is that markets are always upwardly biased in the long run. A diversified portfolio is always upwardly biased in the long run."

Bottom line: whatever the disruption, those who stay invested realized gains over the long term.

What happens if you sell when the markets are down?

First, you'll turn a paper loss into a real loss, explains Burlacoff. Then, once you're out of the market, you'll have to decide when to get back into the market.

"When markets start to recover, they often recover swiftly, significantly and unexpectedly," says Burlacoff.

So, what happens when markets recover unexpectedly? "You have to be in the market to get the gains that are there," he says. "And if you're out of the market, you can suffer significant financial losses over a long period of time."

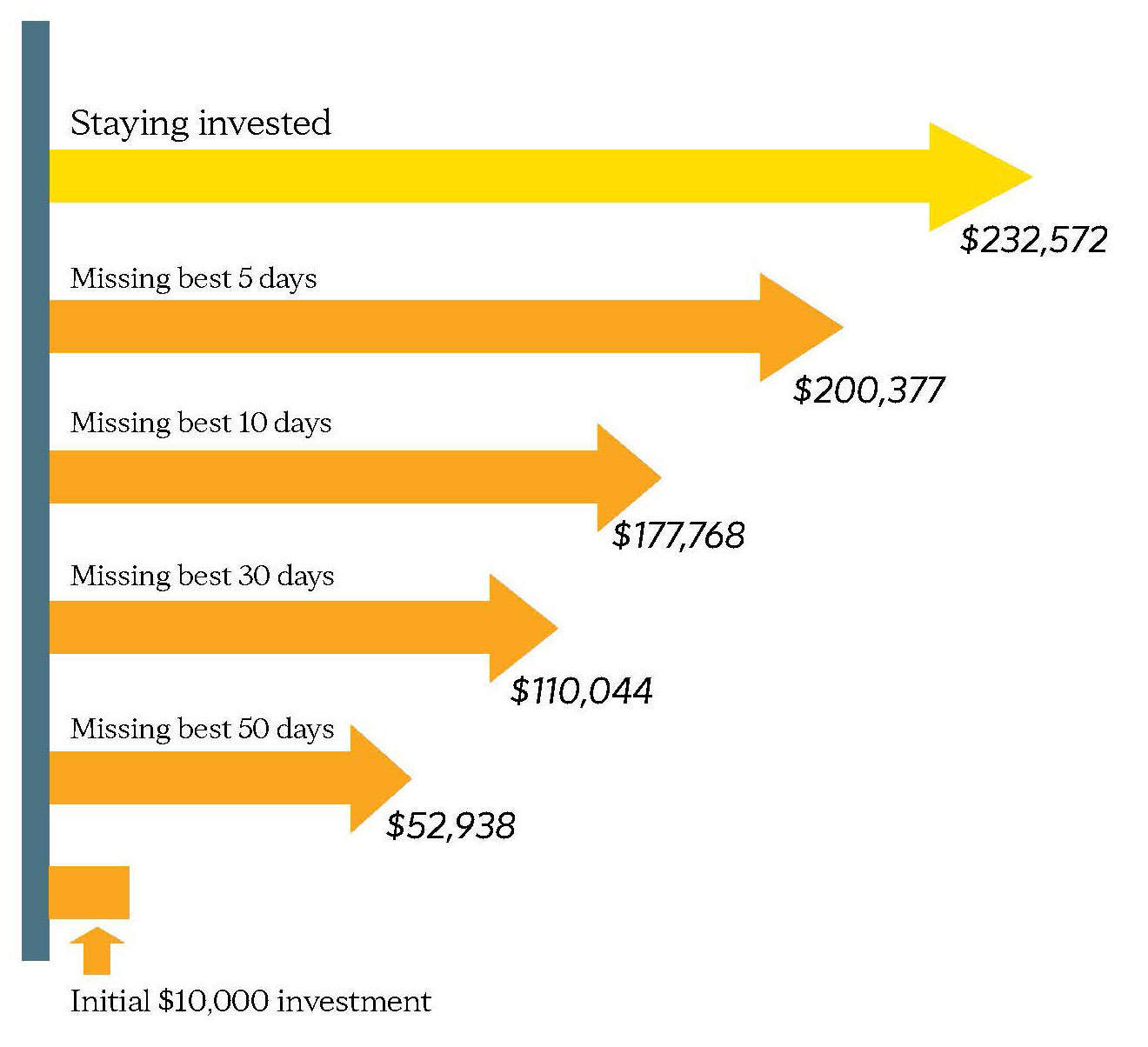

Let’s look at an example of a $10,000 investment on January 1, 1985.1

See how missing just the 5 best days, over 35 years, means a return of $32,000 less than if you just left your money invested? In a worst-case scenario, missing the best 50 days means you end up losing money on your initial investment.

Also, when market values go down, you’re able to buy more units of some mutual funds. For example, let’s say you contribute the same amount each month to an RRSP that holds mutual funds. This month market values are down, compared to the previous month. Your contribution this month therefore buys more units in the lower-valued mutual funds than it did the month before. Later, if market values rise, you’ll benefit from the recovery, as prices for the units you bought rise.

How can you keep your financial goals on track during a market downturn?

If you want to keep your finances on track, start by asking yourself these three questions:

1. Have your financial goals changed?

2. Do you have a diversified portfolio?

3. How comfortable are you with risk?

You may be better off staying the course and sticking to your original plan if:

- your goals haven't changed, and

- you have a diversified portfolio.

Remember, history tells us that markets grow over the long term.

Are you worried about volatility risk or inflation risk? Or maybe you're concerned that your portfolio lacks diversification? In such cases, talking to a professional may help.

Now is a good time to reach out to your advisor if you have one. Or to find a Sun Life advisor if you don't. (Most advisors now offer to meet Clients virtually by video chat).

An advisor can help you:

- make well-informed decisions,

- understand what your risk tolerance is,

- make a plan and build an investment portfolio that meets your long-term goals,

- feel assured in times of uncertainty, knowing you've taken steps to prepare, and

- avoid making emotionally-driven decisions about your savings.

*Definition of terms:

Market volatility refers to dramatic swings or ups and downs in the markets.

A diversified portfolio includes various assets like stocks, fixed income, and commodities. These assets may react differently to the same economic event. The value of one may rise while the value of another may fall. This lowers your overall risk because no matter what happens in the market, some assets will still have gains.

1 Global stock market represented by MSCI World Source: Morningstar.

This article is for information and illustrative purposes only. It's not intended to provide specific financial, tax, insurance, investment, legal or accounting advice. It does not constitute a specific offer to buy and/or sell securities. We've compiled information in this article and webinar from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.