Diversification is a strategy that spreads your risk as an investor over different types of investments. The aim is to balance both the overall risk and your potential returns.

By diversifying, you also help protect your savings from the market’s ups and downs. This happens because different types of investments, such as stocks and bonds, often move in different directions.

Here’s what you need to know about diversification – and how it can help you as an investor.

Does diversification help to reduce risk?

If you hold just one type of investment, you could put yourself at risk. Why? If your investment performs badly, you could lose a lot of money.

To boost your portfolio’s resilience, diversification is the answer. It’s unlikely all your investments will perform badly at the same time. Good returns on some of your investments can balance out the losses on the others.

How can you diversify your investment portfolio?

You can diversify your portfolio by:

- Choosing different investment types (i.e. stocks and bonds)

- Varying the level of risk within investment types (i.e. low, medium and high)

- Including investments from different regions of the world (i.e. Canadian, U.S., emerging markets, etc.)

- Having multiple management styles (i.e. active, passive, index, etc.)

What are some low-risk investments?

Different investment types each have their own purpose. They have varying levels of risk and potential returns. Let’s break down the types of investments based on their level of risk:

Lower risk investments

Cash equivalents, such as money market funds, provide low risk returns. They generally include investments such as guaranteed funds and short-term deposits that pay you interest. While the risk is low, many cash equivalents also have low rates of return.

Medium risk investments

Fixed-income investments, such as bonds, are generally higher risk than cash equivalents. But they offer potentially higher returns. When you invest in bond funds, you lend money to the company or government issuing the bond. They repay the amount of the loan plus interest over a specified period. Bond fund values go down when interest rates go up, and vice-versa.

Higher risk investments

This includes equity funds which are made up of stocks. These are higher risk than cash equivalents or fixed-income investments. But with higher risk comes a higher potential for long-term growth. Equity funds give you an ownership interest in the issuing companies. If there’s an increase in the companies’ value, you’ll see investment gains.

How does investment risk vary by age?

Your age tends to dictate how much risk you're willing to take on in your investments.

Early in your career

With retirement decades away, you have time on your side. You can increase your portfolio’s long-term investment risk and set yourself up for higher potential returns.

Mid-career

Retirement is still years away, so you still have lots of time. You’ll want a moderate increase in the long-term investment portion of your portfolio.

Close to retirement

As you near retirement, now's the time to ensure that your portfolio reflects your retirement income goals. This is the time to reduce your portfolio’s investment risk. And that’s the whole purpose of having a diversified portfolio.

How much you will save by the time you retire?

Use our retirement savings calculator to find out.

How can you diversify your investments?

Diversifying within an investment type can make your portfolio more resilient to stock market ups and downs. Since investments react differently to the same event or crisis, returns will be different from one investment to the next. Losses in one area may be offset by gains in another. There are two main ways you can diversify your investments.

1. Explore new regions

Diversifying by region means investing not only in Canadian funds, but also in foreign funds. This strategy increases your chances of growth while managing risk. You benefit from the strength of different markets, while reducing the risks of having all your investments tied to just one region.

Read more: What is ethical investing?

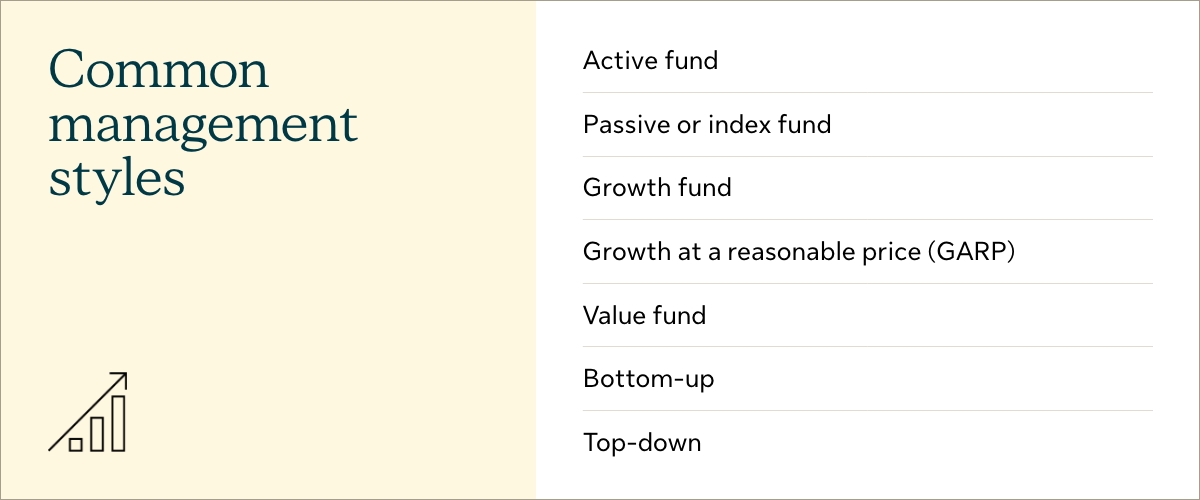

2. Mix up management styles

Managers apply varying investment styles when choosing underlying stocks for their funds. Different styles perform well in different economic cycles and environments. No single management style consistently outperforms the rest. Common management styles include:

- Active. Fund managers choose funds they expect will have the best potential returns.

- Index or passive. Managers try to match the returns of an index, such as the S&P/TSX Composite index. They do this by selecting stocks from the benchmark index.

- Growth. Managers invest in companies experiencing a rapid growth in profits.

- Growth at a reasonable price (GARP). Managers look for stocks of growth companies they can buy for a reasonable price.

- Value. Managers search out companies they believe are undervalued by the market.

- Bottom-up approach. Managers focus first on the fundamentals of a company before looking “up” at other factors, such as the economy.

- Top-down approach. Managers examine an industry’s broad economic outlook. Then they look “down” to select stocks from that industry.

Need help diversifying your investment portfolio?

When it comes to investing, it’s important to keep sight of your long-term goals. Diversification is how to achieve them.

Need more advice? Speak with a qualified financial professional about what level of risk is right for you, and how to diversify your portfolio.

Find an advisor near you. They can help you:

- understand what your risk tolerance is, and

- make a plan and build an investment portfolio that meets your goals.

Read more:

Worried about volatile markets?

This article is meant to provide general information only. Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation.