On March 26, 2024, the DB Solutions (DBS) team hosted Focus 2024: a bright path forward. The webinar was packed with insights from Rob Turpin from Ottawa International Airport Authority, and consultants, Lydia Audet and Louis-Bernard Désilets from Normandin Beaudry. They shared details of how three inflation-linked annuities reduced defined benefit (DB) pension plan risk.

Umesh Haran from DBS walked us through trends from the 2023 group annuity market. And Neil Tai-Pow from SLC Management shed light on the strategic use of private debt within liability-driven investment portfolios.

Here are my top five takeaways from the event:

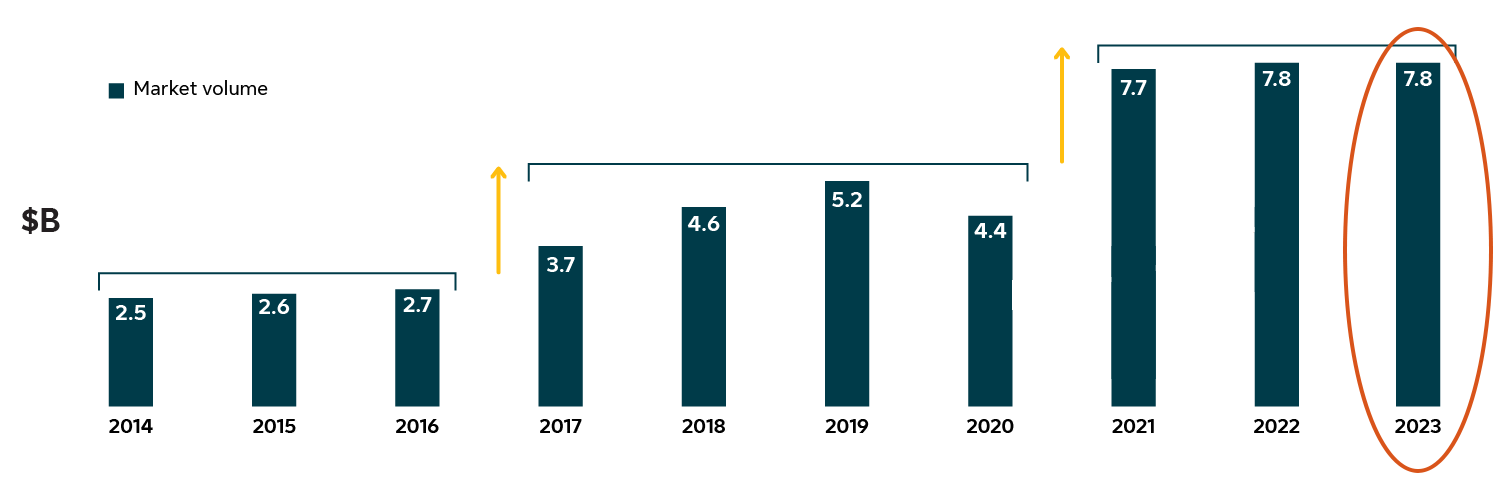

1. The group annuity market has substantial room for growth

2023 was another record year!

Evolution of the Canadian group annuity market

Source: The Secure Retirement Institute Canadian Pension Market report published by LIMRA, March 12, 2024.

The group annuity market continues to have strong momentum. Around 140 DB plan sponsors made the decision to de-risk in 20231 with $7.8 billion in transactions.2 However, the market still has substantial potential for growth. WTW estimates that only 12% of private sector DB liabilities have been de-risked using annuities.

One indication of the growing interest in annuities is that there are $18 billion in deals currently being discussed.3 While not all these deals are expected to transact in 2024, gradual annual market growth is expected. It’s exciting to see large employers with sizable pension plans take action, such as Ford of Canada. The popularity of group annuities will continue to rise as more organizations realize the benefits of de-risking.

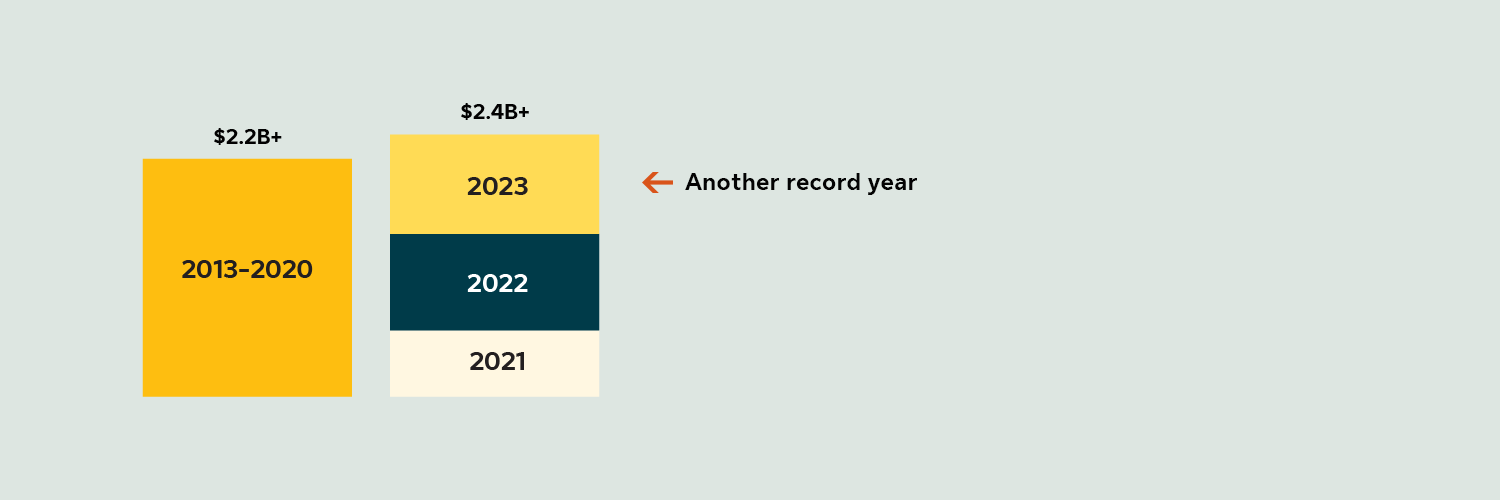

2. Inflation-linked annuities continue to gain attention

It was another record year with $925 million of inflation-linked annuity transactions.3 To put this into perspective, there were more inflation-linked annuity deals in the last 3 years than there were in the 8 preceding years. This is no surprise given rising inflation rates. The evolution and sophistication of inflation-linked solutions also drove the market.

In 2022, the Government of Canada announced its decision to cease real return bond (RRB) issuance. This will impact the supply of RRBs, which are the most efficient way to back inflation-linked annuities. So, while RRBs are still available, it’s unclear how long this will last. As Umesh Haran, Director, Client Relationships for DBS shared, “the future of inflation-linked annuity solutions will eventually look different and will likely be more expensive. There’s an opportunity to take advantage of RRBs while they’re still available by bringing inflation-linked liabilities to market this year.”

The time for inflation-linked annuities is now

Inflation-linked annuity market volume

Take advantage of RRBs while they are still available.

3. Investment grade private credit can provide a unique advantage

Private credit has become a hot topic in recent years. Neil Tai-Pow, Senior Director, Client Solutions at SLC Management, emphasized that “with fixed-income playing a larger role in many plans, it’s become important for fixed-income portfolios to generate sufficient yield to keep pace with liability growth and have well-diversified credit exposure. This is where investment grade private credit can play a useful role.”

Neil shared key benefits of private fixed-income, which include:

- Potential for higher yields than public fixed-income due to a spread for illiquidity and complexity.

- Improved diversification from transactions and issuers not available in public markets.

- Liability-hedging capabilities due to availability across the maturity spectrum and yields that correlate closely with liability discount rates.

- Favourable downside risk profile due to covenants and collateral that protect investors.

4. Education is key for proper governance

Developing a governance structure is critical – and it starts with education. Rob Turpin, Vice-President, Finance & Chief Financial Officer, Ottawa International Airport Authority shared, “the stable presence of the key decision makers and a well-articulated approach creates an environment of trust and a better understanding of the de-risking process.”

Inflation-linked annuities are a relatively new de-risking solution. Open communication between internal and external stakeholders creates transparency and trust so decisions can be made with clarity and confidence. Lydia Audet, Principal, Normandin Beaudry, noted the importance of addressing clients’ concerns stating “there’s a preconception that buying annuities may come at high costs. By demonstrating the long-term stability they can offer, it helps ensure everyone is on board in the de-risking process.” When everyone is well-informed, plan sponsors, in partnership with consultants and insurers, can ensure a successful transaction and secure pension benefits for plan members.

5. Be 'transaction-ready'

These are huge transactions that require a lot of organization and preparedness. Being transaction-ready means having the necessary documentation, resources, and processes in place to capitalize on favourable market conditions.

Louis-Bernard Désilets, Partner, Normandin Beaudry, shared the importance of having a clear understanding of both the financial and administrative impacts of a group annuity purchase. He recommends auditing member data to ensure it is complete and accurate. Having all the puzzle pieces ready is important – it boils down to strong governance. He shared, “Clarifying in advance the role of each stakeholder and identifying the final decision makers can go a long way on transaction day. The decision making is simplified when you select your purchasing triggers in advance – that’s what the Ottawa International Airport Authority did and we found it extremely helpful.”

I’m always fascinated by the complexity, detail and hard work that goes into an annuity purchase. The Canadian market has a bright path forward. I’m excited for the future and continuing to help organizations de-risk their Canadian pension plans to secure member pension benefits.

To learn more, watch the event recording.

1 WTW (February 27, 2024). Group Annuity Market Pulse – Fourth Quarter 2023.

2 LIMRA (March 12, 2024). The Secure Retirement Institute Canadian Pension Market Report.

3 Sun Life estimates.